Mortgage Update: What is a Seller Buydown?

The mortgage market has experienced significant fluctuations in the past few years, with rates reaching historic lows, then quickly moving higher. Now, mortgage rates are stabilizing close to historical levels, making buyers look for advice to navigate this new mortgage rate market. What are buyers doing in today’s market to bring down the rate? Tracy Leddy from Prosperity Home Mortgage is going to further explain what buydowns are and how they are helping buyers in this unpredictable market.

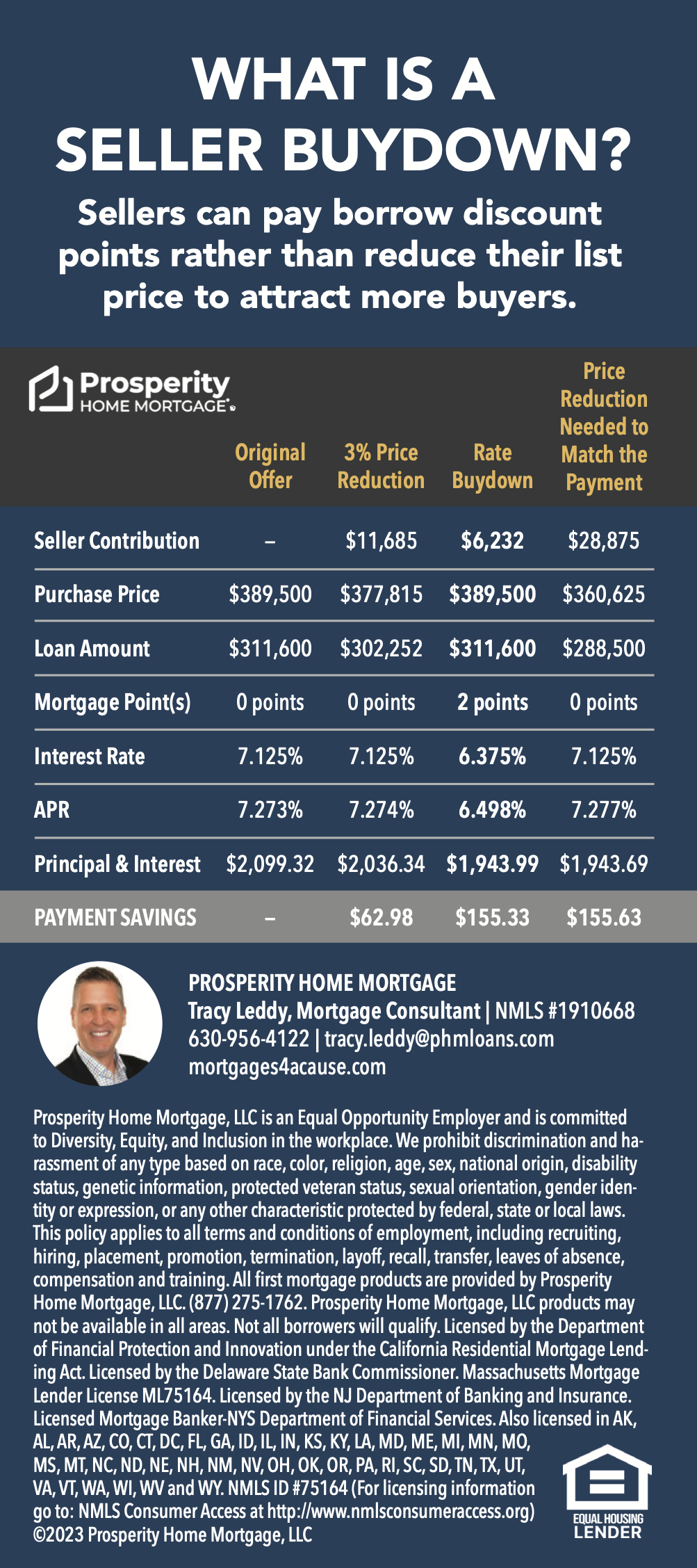

Did you know that you could buydown your interest rate to reduce your monthly mortgage payment and in some circumstances, sellers are paying a portion of the buyers buydown at closing?

Buydowns are subsidies paid upfront to lower mortgage rates temporarily or permanently. The 2-1 buydown is a temporary buydown that allows buyers to pay a lower interest rate for the first two years of their mortgage, while the 1-0 buydown lasts only for the first year of the mortgage. Both options can help buyers save money in the short term, especially if they are on a tight budget or plan to refinance after the first year.

Remember, you can refinance your mortgage interest rate as soon as 6 months after you close on your new house.

The permanent buydown is a more permanent solution that allows buyers to pay a lower interest rate for the life of their mortgage. This option is ideal for buyers who plan to stay in their home for a long time and want to save money on interest over the life of their loan.

The subsidy for the 2-1 buydown is provided by the seller, for the 1-0 buydown, it is provided by the lender, and for the permanent buydown, the subsidy may be provided by either the seller or buyer.

What makes Prosperity Home Mortgage stand out in this marketplace?

If a refinance opportunity arises before the end of 2025, PHM will cover the refinance costs by covering the origination fee, which saves buyers up to $1,349.

Remember, you’re dating the rate and marrying the house.

By staying informed and being proactive, buyers can make smart choices when navigating the new mortgage rate market. Current mortgage rates like real estate can be very fluid and changing quickly. It’s best to navigate these waters in a collaborative effort with a great realtor and lender. You don’t need to take this journey alone, and it’s always in your best interest not to.

Whether you’re selling a home or buying a home, The Move Smarter Team can help you navigate this process. Click the button below to get started. Samantha and Raul are ready to help.